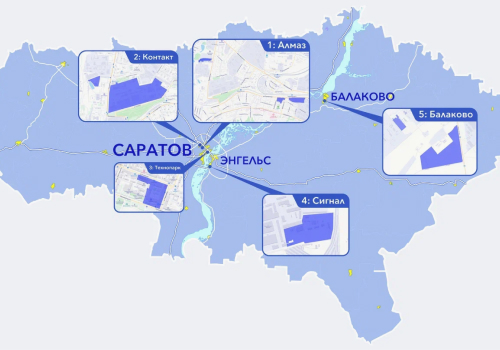

Special economic zone of technical and innovative type "Almaz"

A special economic zone of the technical and innovative type of the Saratov region was established in 2020 by Decree of the Government of the Russian Federation No. 763 dated May 27, 2020 "On the creation of a special economic zone of the technical and innovative type in the territories of Engels, Balakovo municipal districts and the municipal formation "City of Saratov" of the Saratov region"

- 3 residents at the site in Saratov

- 1 resident in Engels district

- 2 residents in the Balakovo district

from 1680 ₽/ m2/yearVacant industrial premises

from 2880 rubles/m2/yearVacant office space

Technical and implementation activities

Industrial and production activities

On the sites in the special economic zone, there are sites provided with both infrastructure and without infrastructure

Development of mineral deposits, except for the development of mineral water deposits and other natural medicinal resources; Production and processing of excisable goods (except for the production of passenger cars, motorcycles, production and processing of ethane, liquefied petroleum gases and liquid steel)

- Postal services

- Accounting services

- Advertising services

- Secretarial services

- Services in the field of land and property relations

- Services in the field of customs relations

- Procurement services

- Services to potential SEZ residents

- Intellectual property services

Regional budget: the first five years - 0%; from 6 to 10 years - 5%; starting from year 11 - 13.5%

Federal budget: 2%

0% 10 years

0% 5 years

0% 10 years

For SEZ residents applying the simplified taxation system and who have received resident status, starting from 01.01.21, preferential tax rates have been established in the following amounts:

2%if income is the object of taxation (the total rate is 6%)

7.5%if the object of taxation is income reduced by the amount of expenses (the total rate is 15%)

Yes (for individual sites)

Sending an application, a business plan for an investment project with appendices to the Ministry of Economic Development of the Saratov Region (in accordance with Article 13 of Federal Law No. 116-FZ dated July 22, 2005 "On Special Economic Zones in the Russian Federation")

Obtaining approval of the business plan of the project by the SEZ Supervisory and Expert Council;

Conclusion of an agreement on the implementation of activities in the SEZ with the Ministry of Economic Development of the Saratov region and the management company;

Making an entry in the register of SEZ residents

There is no minimum investment amount for obtaining resident status

120 million rubles is the minimum investment amount for obtaining resident status